Description

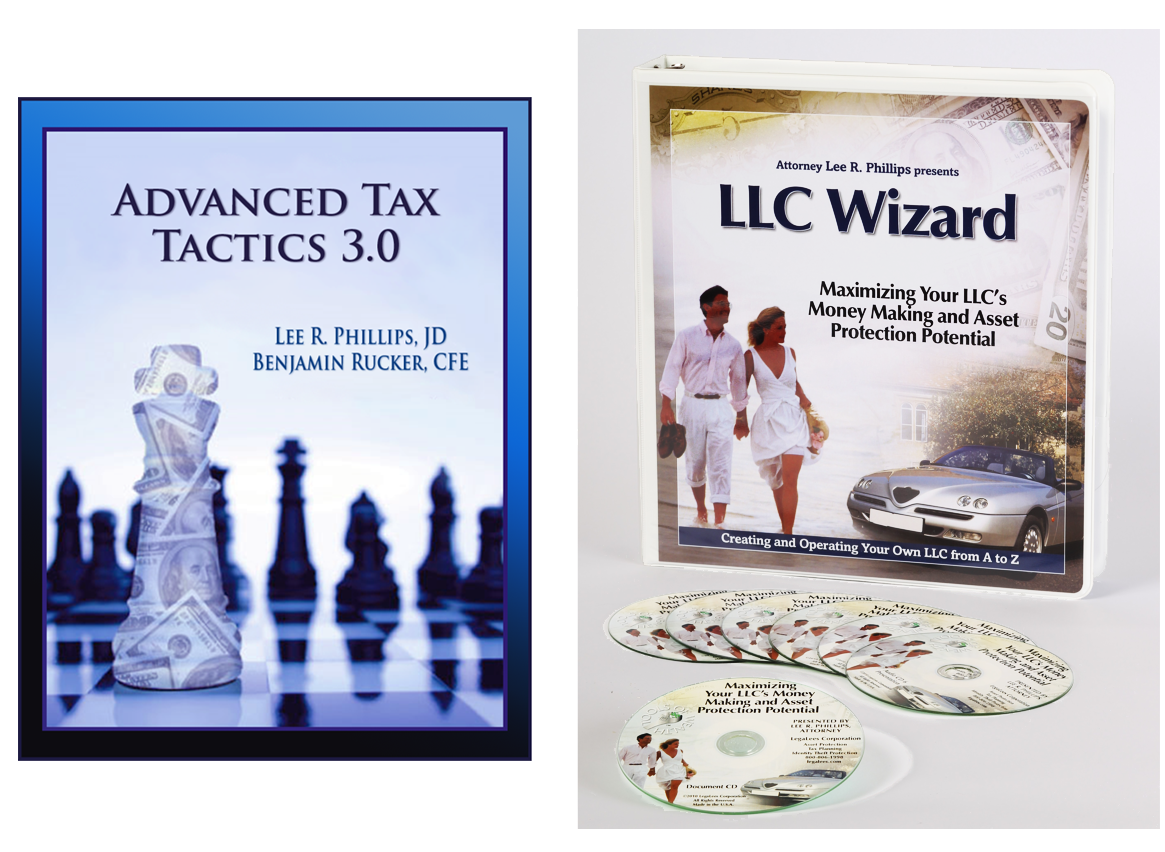

LLC Wizard

This is the most comprehensive course on the market to teach anyone how to set up their own LLC and then use it to get more asset protection and more money. It is delivered in hard copy with electronic components.

If you want the full asset protection and money making potential of your LLC, forming and using an LLC has to go way beyond the few papers you get off the internet or at the attorney’s office to start a business. The LLC Wizard goes the full distance to let you:

* Protect members and managers from business liabilities

* Protect business assets from personal liabilities

* Make more money!

* Avoid estate taxes and probate on your LLC

* Make your life easy

* Get a more tax deductions

* Lower your Adjusted Gross Income (AGI)

The LLC Wizard gives you:

* 6 hour audio course

* Over 220 pages of printed supporting documents

* A step-by-step guide so you can customize computerized LLC forms and documents

* Use of the computerized documents over and over again

* The ability to design customized documents for your unique situation

* All of the money making and asset protection potential an LLC offer

The LLC Wizard lets you “control” your taxes. An LLC has the most flexible tax structure of any type of legal structure. It also gives you double the asset protection you’ll get from a corporation. Our goal is to cut your taxes by 20% to 30%. In order to reach our goal, you’ll have to have the Advanced Tax Tactics, so we have provided you with a digital delivery version.

Ten years ago, I wanted to cut my taxes. I searched and searched for ways to lower my tax bill. I wanted to make more money and not work harder. I was already working too hard, like I am sure you are doing. There wasn’t any tutorial or guide to lowering your tax bill. I figured out how to cut my adjusted gross income by a lot. That lowered my taxes.

Advanced Tax Tactics 3.0

So I created the Advanced Tax Tactics. Later, Ben Rucker, a former IRS Special Auditor/Agent, came to work with me and we have improved the Advanced Tax Tactics and kept it up to date. Using the info in the Advanced Tax Tactics, if you don’t get an extra couple of thousand dollars each year to spend, something is wrong. We need to talk.

Advanced Tax Tactics has been fully updated to teach you how to take advantage of the Trump tax laws. Two of the best tutors in the area of taxes and asset protection bring the tax laws down to earth so you get the practical instruction on how to use them. Not only do you get more money, you cut your audit risk substantially. We give you the inside scoop on how to save on your taxes by proactively setting yourself up for success. Using these legal tools will enable you to keep more of the money you make.

The IRS is a major impediment both to keeping or growing what you have been able to make. Use the correct structure to minimize the IRS tax effects and you’ll have a lot more money to work with year after year well into the future.

Most tax tips on the net or in print don’t apply to the average tax payer or even the small business folks, real estate investors, and professionals. The tax tips you’ll get here have been carefully developed for successful business people, professionals, real estate investors, or any other American tax payer. Proactively set yourself up for success by using these legal tools to keep more of the money you make.

• 3 HOURS of both Lee and Ben weighing in to give you the best ideas

• Accompanying written material lays all the information out for you to see and easily refer to

The product comes in two parts:

1. Advanced Tax Tactics Audio Training—3 HOURS of step by step explanation of how to use legal loopholes to maximize your net earnings

2. Companion Manual/Workbook, to help you assess exactly what type steps you can take to maximum tax savings

There’s a problem if you can’t cut your tax bill by 20% after using the Advanced Tax Tactics. It’s fully updated for the Trump tax laws. It gives you solid black-letter tactics that you can use to cut your adjusted gross income. It leads you through what you need to do to put your AGI on a diet.

The Biden administration is working on a major tax redo. When we know what happens, we will update the Advanced Tax Tactics, and you’ll be entitled to a free digital update.

Your CPA just plugs in the numbers you give him. You’ve got to live life every day so you can “create” the numbers your CPA uses, and Advanced Tax Tactics shows you step by step what to do. The three hours of audio instruction in the Advanced Tax Tactics will return you thousands, if not tens of thousands, of dollars in tax savings for every hour you spend. Could you spend three hours to make an extra ten thousand this year? You can’t work any harder, but the Advanced Tax Tactics can get you a lot more money to spend.

The IRS is a major impediment to financial success and security. Combine the law and the IRS loopholes and you’ve got success and security. The Advanced Tax Tactics will work for you year after year to make you more money and give you more security. Plus we’ll show you how to minimize your chances of an IRS audit.

Advanced Tax Tactics is prepared by two of the best tutors in the area of taxes and asset protection. They bring the tax laws down to earth so you get the practical instruction on how to use them. Not only do you get more money, you cut your audit risk substantially. Meet your instructors:

Lee Phillips is a United States Supreme Court Counselor who has helped over a half million people understand how to use the law to make more money and protect their assets. He has practiced law for over 30 years and helped some of the wealthiest people in the US and Canada protect themselves. He is admitted to the United States Supreme Court, US Court of Federal Claims, US Federal Tax Court, and numerous other Federal and state courts.

Ben Rucker is an accountant with a Masters in Tax who spent 7 years as an IRS Special Enforcement Auditor. He is a certified fraud examiner. His tax planning strategies often result in substantial tax savings and reduced audit risk through legal and ethical strategies. He helps reduce your legal risk and pay less in taxes by teaching you to implement the best tax structure, keep correct books and records, and get time your income so that it will be taxed at a lower rate.

Check out the topics Lee and Ben cover in detail for you:

History and Overview

New! Personal Deductions

Business Matrix

Sole Proprietorship

General Partnership

S Corporation

New! 199A

C Corporation

Expanded! HRAs

Business Deductions

Shifting Income

Audits

IRAs

Charities

Reviews

There are no reviews yet.